Does the RAV4 Prime Qualify for a Federal Tax Credit? (2024)

It’s only natural to try and get as much money off of your EV or hybrid vehicle as possible. With all of the tax rebates and incentives over the previous years, you want to search out what’s available to you. That leads you to wonder if the RAV4 Prime tax credit still exists and how much it is worth.

No, the Toyota RAV4 Prime does not qualify for the United States federal tax credit in 2024 because its final assembly does not take place in North America.

If you live in Canada, the RAV4 Prime does currently qualify under Canada’s iZEV program.

Below, I cover the details of the RAV4 Prime federal tax credit status and discuss some changes that have occurred.

This guide is only for the RAV4 Prime. If you are wondering about the tax credit for the electric model, read our Toyota RAV4 Hybrid Tax Credit article instead.

What Is the Federal EV Tax Credit?

The federal electric vehicle tax credit first arrived in 2010. The United States government provided an EV tax credit of up to $7,500 for new electric vehicle purchases.

This means that when you purchase a qualifying electric vehicle, you receive up to $7,500 in credit against your personal tax liability. This can drastically reduce your taxes, but it will not provide a tax refund. This federal tax credit is a huge benefit for many individuals interested in buying an electric vehicle.

The tax credit comes with stipulations, though. For example, automakers had a cap on tax credits once 200,000 electric vehicles were sold.

This sales cap was met by Tesla and General Motors, making them unable to sell vehicles that are eligible. Toyota also hit this 200,000 vehicle mark in June of 2022. Without any further legislation, Toyota would have phased out the tax credits by October 2023.

Although this 200,000 limit was removed in 2023, there were additional restrictions added to the rules as well (IRS.gov).

Here is a helpful video explaining how federal EV tax credits work:

Tax Credit Qualification Status

In the United States, the Toyota RAV4 Prime used to qualify for a tax credit of up to $7,500, but it no longer qualifies.

Credits are phased out after a manufacturer sells 200,000 qualifying vehicles. As previously discussed, Toyota hit this sales mark in June of 2022. That should have allowed Toyota to qualify through October 2023. However, new legislation changed the rules.

In August of 2022, President Biden passed the Inflation Reduction Act. In this legislation, federal EV tax credits are limited to those where final assembly occurs in North America. Japanese plants are responsible for producing the RAV4 Prime model, making it ineligible.

Let’s look back at the previous rebates offered on the RAV4 Prime and other models from Toyota.

- 2021-2022 Toyota RAV4 Prime: $7,500 (Before 9-30-22)/ $3,750 (Remainder of 2022)

- 2012-2014 Toyota RAV4 EV: $7,500 (Before 9-30-22)/ $3,750 (Remainder of 2022)

- 2017-2022 Toyota Prius Prime: $4,502 (Before 9-30-22)/ $2,251 (Remainder of 2022)

- 2012-2015 Toyota Prius Plug-in Hybrid: $2,500 (Before 9-30-22)/ $1,250 (Remainder of 2022)

- 2023 Toyota bZ4X Plug-in Electric: $7,500 (Before 9-30-22)/ $3,750 (Remainder of 2022)

While Toyota models are no longer eligible for federal tax incentives, it’s still possible to get local rebates. Many states have offers through local electric companies. It’s wise to do some research about your region before choosing an EV or hybrid vehicle to drive.

Why Doesn’t It Qualify?

The Inflation Reduction Act added a lot of regulations for vehicles to qualify for federal rebates.

Sadly, Toyota was disqualified from the federal tax credit because the RAV4 Prime isn’t assembled in North America.

For now, Toyota manufactures the RAV4 Prime in Japan.

The rules for vehicles that are assembled in North America have also changed. To get federal tax credits, the following conditions must be met.

- Income requirements: Single buyers can only make up to $150,000 per year, while joint taxpayers have a cap of $300,000.

- Vehicle price: To qualify, sedans must cost less than $55,000. SUVs, trucks and vans have to sell for less than $80,000. With a used vehicle, the price cap is $25,000, no matter what type of vehicle it is.

- Battery construction: The batteries must have a particular amount of materials sourced from North America or a free-trade partner with the United States. Plus, the vehicle must be assembled in North America. At this time, no electric vehicle meets these stringent guidelines.

Additionally, in 2024, EV tax credits can be received directly from the dealership during the sale. No longer will customers need to wait for income tax returns to get the credit.

Will It Qualify in the Future?

There’s no clear-cut answer to this question, but there is some hope. The 200,000 vehicle production limit was removed in 2023, meaning that Toyota could be eligible once again. Still, with final assembly occurring in Japan, the RAV4 Prime still won’t qualify.

However, Toyota plans to open new battery manufacturing facilities in North Carolina and Michigan in 2025. This may allow the RAV4 Prime to qualify for the tax credit once again.

Toyota could move final assembly to North America, but that takes a lot of money and tons of plant modifications. Even if Toyota took the time and money to make these changes, the other qualifications make it difficult to become eligible again. For that reason, it might not be worth the automaker’s time to make changes.

At this time, I have no reason to believe that RAV4 Prime assembly will be moved to North America. If something changes in the future, I will update you.

Alternative Vehicles That Qualify for the Credit

Since the RAV4 Prime is not an option for taking advantage of the federal tax credit, you may be thinking about exploring other options.

Luckily, there are some great vehicles to choose from that qualify for the tax credit.

Vehicles that currently qualify for the full $7,500 tax credit:

- 2022-2023 Chrysler Pacifica PHEV

- 2022-2023 Lincoln Aviator Grand Touring (PHEV)

Vehicles that currently qualify for the partial tax credit ($3,750):

- 2024 BMW X5 xDrive50e (PHEV)

- 2022-2023 Ford Escape Plug-In Hybrid (PHEV)

- 2022-2023 Jeep Grand Cherokee PHEV 4xe

- 2022-2023 Jeep Wrangler PHEV 4xe

- 2022-2023 Lincoln Corsair Grand Touring

Keep in mind that when choosing an alternative vehicle, the features, styling, reliability, and other factors will be different. If you really like the features and design of the RAV4 Prime, it still might be worth considering (I’ll talk more about that at the end of this article).

Is It Still Worth Buying?

Now that you can’t get the RAV4 Prime tax credit, you might wonder if the Prime is worth buying at all.

After all, the RAV4 Prime is an expensive vehicle with a starting price of nearly $15,000 more than a standard RAV4. Sure, it is more fuel efficient, but will that offset the high price point?

Personally, I don’t think it is worth it for people who are trying to save on fuel costs.

When I dove deep into whether or not the RAV4 Prime is worth it, I concluded that you shouldn’t be buying the RAV4 Prime to save money on gas, especially without the tax credit. You simply won’t be saving enough on fuel to make up for the high price tag.

Previously, the federal tax credit made this purchase a bit more sensible. Since the credit has faded away for now, this leaves many people changing their minds and opting for the non-hybrid RAV4 or RAV4 Hybrid instead.

One option is to find a RAV4 Prime used. Many people bought them with the credit and are now off-loading them after only a year or so.

Another complexity is that there are many buyers on a long waitlist to receive a RAV4 Prime. These waitlists sometimes extend for years. These would-be RAV4 Prime buyers have had the rug pulled from underneath them as they will no longer receive the tax credit they expected.

That being said, there’s still a strong argument for buying a RAV4 Prime. Even without the rebate, the Prime may be worth it to some. The advanced technology and efficient power make it a leader in the segment. Not to mention Toyota being notorious for their reliability. It’s a truly unique vehicle, especially from Toyota’s lineup.

Aside from that, it’s difficult to get a rebate on any vehicle right now. In my opinion, it’s not worth making a decision based on the rebate information. Instead, it’s best to pick a model that meets your needs and fits your budget.

Other Ways to Save On Your Purchase

Still want to stick with the RAV4 Prime? I don’t blame you!

Although you won’t get the tax credit, there are some other ways that you can potentially save money on a RAV4 Prime.

- Toyota occasionally offers special deals and incentives, but this is unlikely since the RAV4 Prime is in such high demand

- Check state or local tax incentives

- Look for a used Prime

- Pay cash to save on loan interest

- Compare prices from multiple sellers, including for used RAV4 Primes

- Use your old car for trade-in credit

(Toyota, taxact.com)

Canadian iZEV Tax Credit

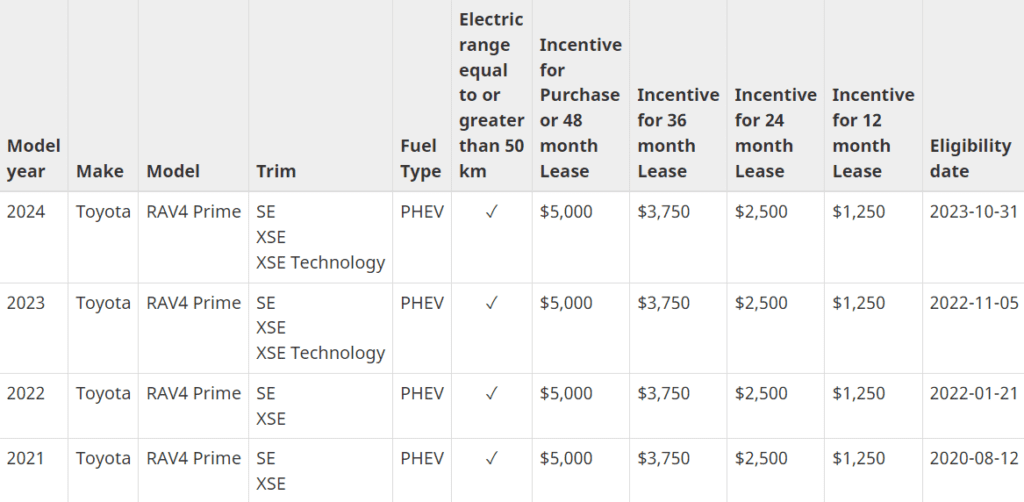

Luckily for our Canadian readers, Canada has continued to offer their $5,000 tax incentive for PHEVs. The Toyota RAV4 Prime has qualified for this since 2021 and continues for the current year. The incentive is decreased if you lease for less than 48 months.

RAV4 Resource Car Concierge Service

We offer a car buying service for both new and used vehicles. If you would be interested in letting us track down the vehicle of your dreams, contact us here.